Community feedback shapes Capital Value implementation

Following extensive community engagement and feedback received from residents regarding the change to a Capital Value rating system, Whyalla City Council has listened to this feedback and made several key changes to address concerns.

Council is required by legislation to change the basis of its property rating from Site Value to Capital Value, but was able to consult on details related to its implementation that the community could influence.

As a result, several key changes added to the policy – which has now been adopted – include:

- Maintaining a differential for Coastal and Rural Living properties, setting these groups at 70% of the Residential rate in the dollar

- Reducing the impact on non-capped properties by increasing the level of annual capping for residential properties in year 1 to 18% (remaining at 12% for years 2 and 3) and setting a higher cap for non-residential properties

You can find all the detail of the final adopted policy on page 321 of this month’s Ordinary Council Meeting agenda: https://bit.ly/43p9Vo1

Council does not raise any additional rate revenue as a result of the change, it’s simply redistributing how the same amount of rates are collected. As part of this, 5,320 residential properties (51%), will actually pay less rates.

You can find more detail on the change in the FAQ below.

Hardship and payment plan options are available for residents concerned about their ability to pay any increase in rates.

Capital Value Rating Policy – Frequently Asked Questions

Why have Council decided to start rating using Capital Values?

It is important for the community to realise that this was not a Council decision, but is required under changes to state legislation.

The Statutes Amendment (Local Government Review) Act 2021 removed the ability for councils to raise rates using Site Values after the 2023/24 financial year.

Only six councils were impacted by this change, all of them on the Eyre Peninsula, with three already having made the change for 2023/24.

Why did you undertake consultation if the change is mandatory?

Under the Local Government Act 1999, Council is obliged to undertake a Rating Review when changing the basis of rating, which includes the requirement to undertake public consultation. This requirement was not removed, even though the ability to rate using Site Value is no longer available.

Council is consulting on more than just the move from Site Value to Capital Value. This includes the simplification of the system to focus on Land Use rather than Locality, and the increase in the Fixed Charge to reduce the impact of the change. As such, Council chose to consult on details related to the implementation that the community could influence.

If Council starts using Capital Values for rating, am I being punished with higher rates for maintaining my property well?

Capital Values are provided to Council by the Valuer General on an annual basis. The Valuer General does not visit each property on an annual basis to create these valuations.

Instead, the Valuer-General has information on the general features of each property, such as the construction type and size of any buildings and structures that are present. They then compare sales of similar properties in similar locations and apply a valuation increase to each property accordingly.

Therefore, making capital improvements to their property is the only way that ratepayers can impact on their valuation, the general upkeep of a property is not a factor that is considered.

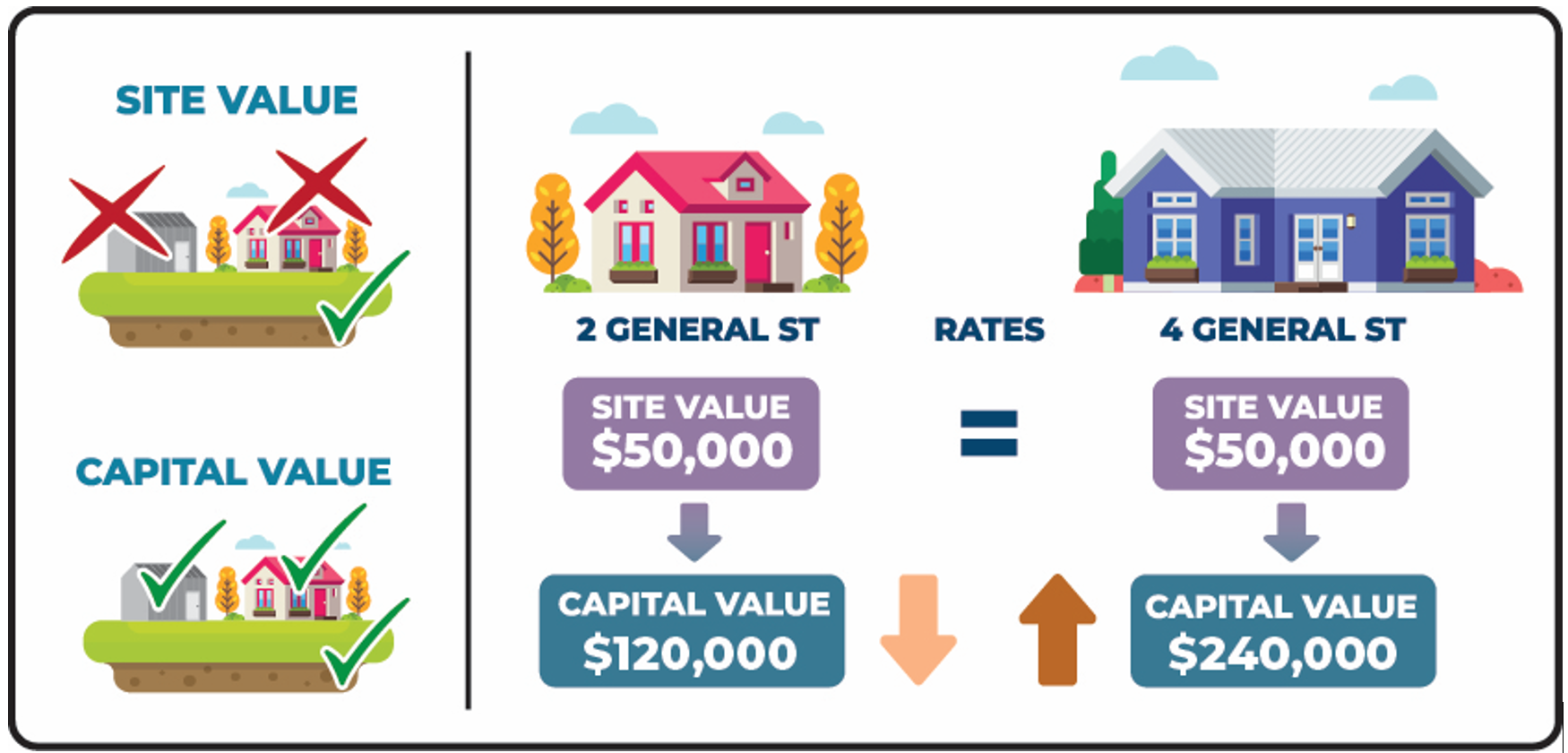

Capital Value is always the same or higher than Site Value, so how will anyone’s rates go down?

Each year, Council calculates the total value of rates to be raised to fund services, with this amount expressed as a % increase from the total rates raised the year before.

Once this value is known, Council first raises the Fixed Charge, and then the remaining amount of rates to be raised is divided by the total value of rateable properties, to calculate a Rate in the Dollar (RID).

As Capital Values are higher that Site Values, the RID calculated using Capital Values will be much lower compared to when Site Value was used. This RID will be used to calculate rates and will result in some properties paying more rates and some less.

The rates I will pay are higher than a similar valued property in Adelaide, why is this?

The average value of a property in Whyalla is lower than that in Adelaide, and the difference can be quite considerable depending on which Metropolitan council you are comparing with.

However, Council still needs to provide the same services that a Metropolitan council provides, and in some cases even more. The cost of providing these services is not cheaper in Whyalla just because our property values are lower, in fact it is often more expensive to provide services in regional areas.

A better measure is the average rates paid by each property, which for Whyalla is slightly below the state average.

I don’t agree with my Capital Value, what can I do about it?

Ratepayers can contact the Valuer-General on their website to appeal the determination of their Capital Value if they do not believe their property valuation is correct, which can be done prior to the changeover.