The way some councils calculate property rates is changing

Why is this happening?

The State Government has made changes to the Local Government Act which is the legislation that specifies the manner in which a Council raises property rates.

What is changing?

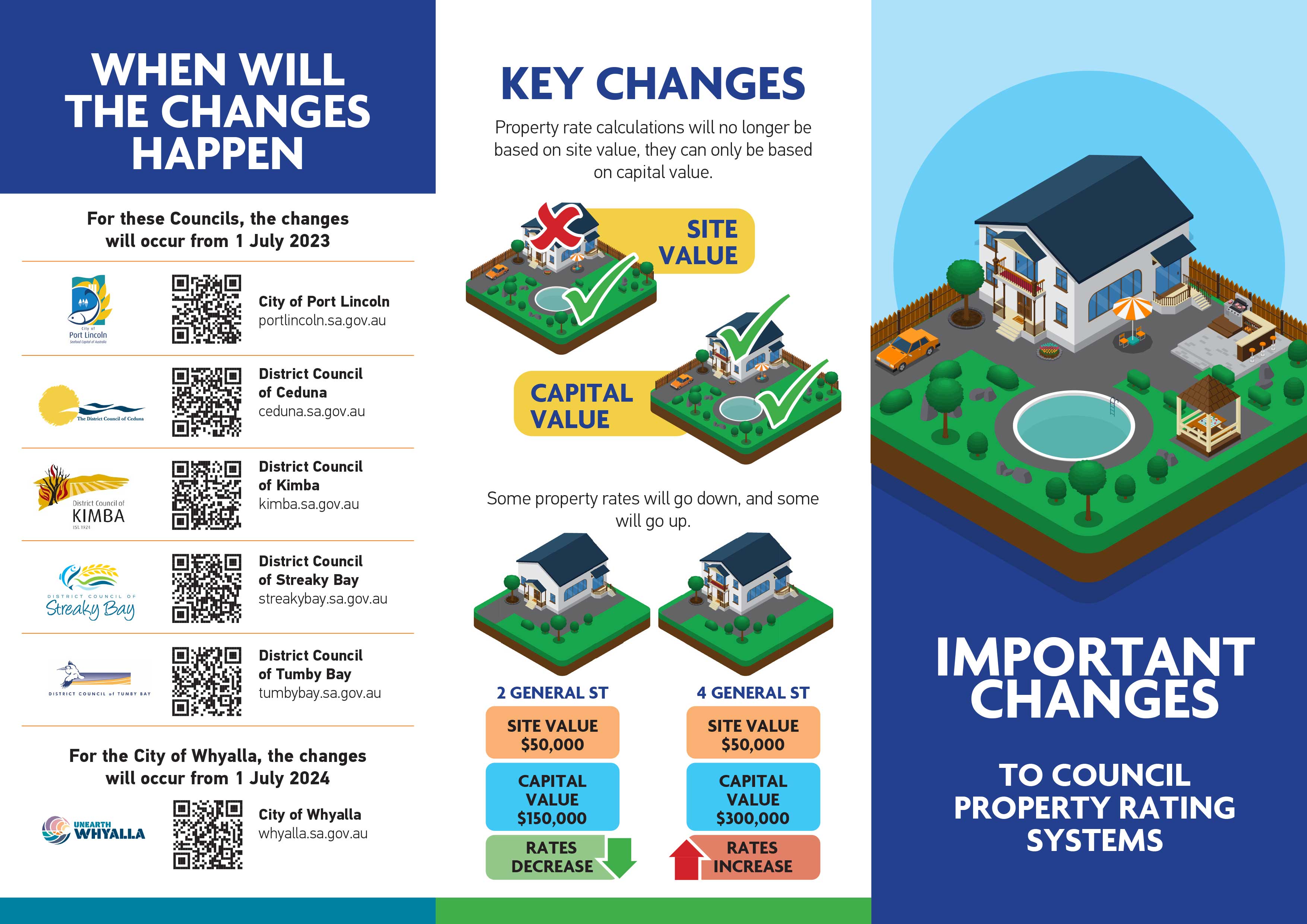

The key change that impacts property rates is that councils will no longer be able to use site value when calculating rates and will need to use capital value. Most councils already use capital value, but a few still use site value.

What is the difference between site and capital value?

Site value uses the value of the land to calculate property rates. Capital value uses the value of the land plus the value of buildings and other improvements to the land to calculate property rates.

How are property values determined?

Property values are calculated by comparing properties to similar properties recently sold, with appropriate adjustments made for any differences.

Each year, the Valuer-General of South Australia independently and objectively determines site and capital values for every rateable property in the state (referred to as the General Valuation). Property valuations may increase or decrease each year depending on changes to the property and other market influences. Most councils in SA use capital value and adopt valuations from the Valuer-General.

How are rates calculated?

There are some variations to this, however in general Councils work out how much revenue they need to raise in total from property rates, then divide this by the total valuations of all the properties in the Council, and the result is a Rate in the Dollar (RID). The RID is multiplied by the property value to calculate the property rates.

What happens when we change to capital value?

Capital valuations are higher than site valuations however Council will still need the same amount of rate revenue in total. The rate revenue needed divided by the total capital valuations will result in a lower RID. If a property’s increase in value due to using capital value is the same as the average for the Council, property rates will not be higher with capital value for that property. However not all properties will change by the average, and some will have higher property rates and some lower property rates.

What is the process for making this change?

The six councils in South Australia who are required to make these changes will work together closely and with the Local Government Association of South Australia to complete extensive modelling of the impact of the changes, consider mechanisms to limit the impact on ratepayers who may be significantly affected by the rating changes and undertake a comprehensive community awareness program relating to the changes.

When is the change happening?

What do I need to do now or what if I have a question?

This information is advance notice of the changes. There is no action required of property owners. Further information will be provided closer to the proposed transition dates for the changes. Although we welcome queries from our community, at this stage, the Councils cannot provide any indication of individual impact on ratepayers, so we can’t tell you how you’re likely to be impacted. This is a part of the modelling process that Councils will need to undertake over the next 12 months. Once this process is completed, Councils will contact ratepayers and provide them with further information.

Rates

In 2023/2024, the City of Whyalla needs to fund total expenditure of $48.9m (excluding Brought Forward). $39.3m will be funded from operating revenue, which includes $20.5m in General Rates and $4.2m in Waste Service Charges less remissions. This means the average residential ratepayer will pay an increase of 8.7% in General Rates, constituting 7.9% CPI plus an 0.8% increase. This is equivalent to a $2.35 increase per week for the average residential ratepayer. Click here to read more about the adoption of the 2023/24 Annual Business Plan and Budget.

Why do we pay Council rates?

The City of Whyalla is responsible for maintaining approximately $495 million worth of community assets which includes local roads, bridges and footpaths, stormwater drainage, land and buildings. In addition, we provide services for the benefit of our residents such as waste management, street lighting, marinas, libraries, an airport and child care centre and many more.

There are also certain services that councils are required to provide under various Acts of Parliament such as planning and development and dog & cat management. The reality is that these services cost money to run and Council rates are the main source of funds to maintain these services and facilities.

At the City of Whyalla we produce a Strategic Plan and 10 Year Forward Financial Estimates that outline the long term priorities and objectives, including infrastructure needs for the community, and the costs to deliver them. This provides the framework for determining the level of rates, debt and service provision for the community.

How are my rates calculated?

The Strategic Plan, which outlines Council's five year objectives and priorities, provides the basis for the Annual Business Plan and Long Term Financial Plan. The Annual Budget is developed from these strategic documents. This shows the full cost to deliver services in a sustainable manner and provides the framework for determining the level of rates, debt and service provision of council.

Once this framework is adopted, the parameters for the budget and the level of rates required to fund the budget are determined. The amount of rates payable by the ratepayer is determined by multiplying their property value by the rate in the dollar plus adding the fixed charge.

In the City of Whyalla, we have a differential rating system and therefore a different rate in the dollar is calculated depending upon the location of the property and its use.

If you believe that your property has been wrongly classified as to its land use, then an objection may be made (to the council) within 60 days of being notified of the land use classification. It is important to note that the lodgement of an objection does not change the due date for payment of rates.

Council has declared the following rates:

A general rate on all rateable land within its area based on two components:

- value of the land subject to the rate; and

- a fixed charge.

A service charge on all rateable land within its area to which it provides a service for the collection, treatment, disposal and management of waste.

A separate rate for the purpose of funding the Regional Landscape Levy on all rateable land situated in the area adopted by council based on a fixed charge. The Regional Landscape Levy is a State Government tax collected on behalf of, and funding the operations of, the Eyre Peninsula Landscape Board.

Property valuations do not determine the rates income to Council

The total amount of rates required to fund Council operations is calculated as part of the budget process, with this then expressed as a percentage increase on the rates collected in the previous year. Valuations are then only used to determine how much each ratepayer contributes to the total rates required.

What if I don't agree with the valuation of my property?

Your property's site value assessment comes from a State Government valuation adopted by the council. If you have an objection, query or appeal in relation to this property valuation, please contact the Valuer-General within 60 days of receiving your annual instalment rates notice. Objections should be forwarded to:

State Valuation Office

GPO Box 1354

ADELAIDE SA 5001

Phone: 1300 653 345

If your objection is upheld, the Valuer-General will advise Council and your rates notice will be amended.

What rate relief measures are available?

Council has budgeted to support rate relief options across the City. This money will reduce rates levied for eligible pensioners, those in the community whose rates increase by more than 25% and community organisations who provide subsidised support services to meet community expectations in areas such as aged care, sport and recreation and education.

Council will continue to provide a refuse service charge concession for eligible pensioners of $178. Apply here

Senior ratepayers may also be eligible to apply to council to postpone payment of rates on their principal place of residence. Postponed rates remain as a charge on the land and are not required to be repaid until the property is sold or disposed of.

Council's Rate Policy and Application Form are available at the council office. The Local Government Act permits a council, on the application of a ratepayer on the basis of hardship, to partially or wholly remit rates; postpone rates; or enter into a long-term payment plan.

Payment of rates

Quarterly payments due:

- 1 September 2023

- 1 December 2023

- 1 March 2024

- 7 June 2024

A quarterly rates notice will be sent to ratepayers at least 30 days prior to each due date. A ratepayer may also elect to pay their rates in a single instalment due by the first due date.

The Local Government Act provides that councils impose a penalty of a 2% fine on any payment for rates received late. A payment that continues to be late is then charged an interest rate, set each year according to a formula in the Act, for each month it continues to be late.

The council allows a further two working days after the due date for payment as a grace period before applying the late payment penalties in the Local Government Act.

Any ratepayer who may, or is likely to, experience difficulty with meeting the standard payment arrangements is invited to contact Kaitlyn Buss on 8640 3444 to discuss making alternative payment arrangements.

For more information contact council:

Civic Building, Darling Terrace, Whyalla

Phone: (08) 8640 3444

Fax: (08) 8645 0155

Email: council@whyalla.sa.gov.au

Website: www.whyalla.sa.gov.au